Watch out for pension deadlines: Prepare for the 55, 65 and 75 age milestones to make retirement comfortable

Pension age deadlines are far more fluid nowadays as older people have gained greater control over when they retire and how they run their finances in old age.

If you’re well prepared to navigate the years between 55 and 75, you can mostly arrange your transition into retirement to your own liking and individual needs.

That said, the traditional age milestones of 55, 65 and 75 are still important markers that call for informed decisions – even if it is just to postpone doing anything while still in the earlier stages.

Milestone birthdays: Ages of 55, 65 and 75 are still important markers that call for informed decisions

It is also absolutely crucial to check and act on any contractual age deadlines that apply in private and occupational pension schemes, or you could have options closed off or find yourself out of pocket.

We take a look at pension deadlines below. Some you can treat as useful signposts to follow along the route to retirement, but others are stricter and will require action if you want to take the best advantage of old age.

Age 55: A ‘false startline’ for retirement

Pension freedom reforms allow over-55s to access their entire retirement savings and do whatever they want with them.

But new rules in 2028 will push pension freedom age back to 57, so anyone now aged 47 or younger needs to bear that in mind and factor it into their plans.

When you do reach 55 – or 57 when the age rise kicks in – there’s no requirement to do anything.

A behavioural study found savers are feeling pressure to use the freedoms immediately when the best course of action is often to do nothing with their retirement pot for now.

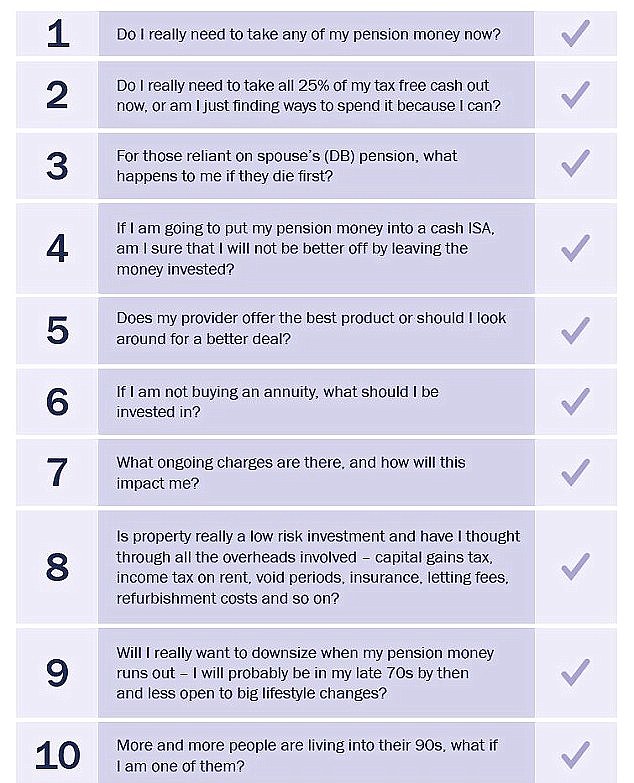

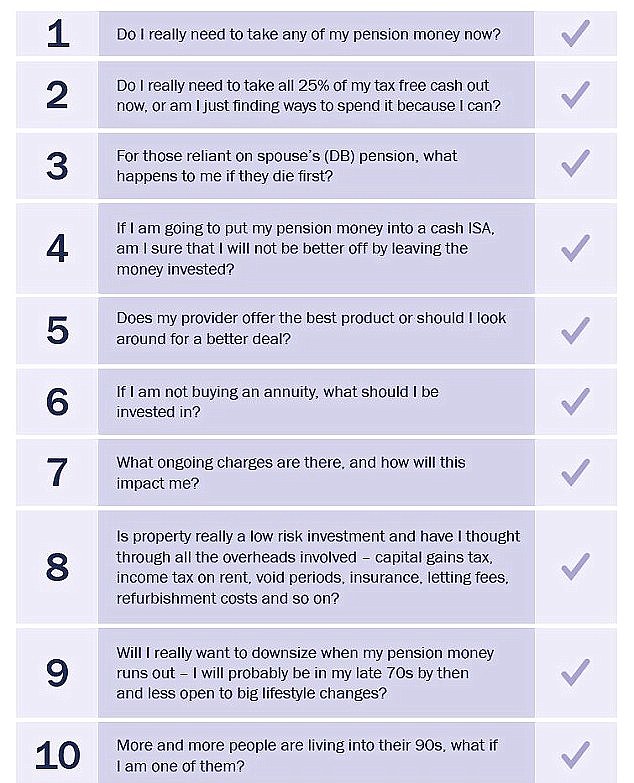

Researchers suggested people ask themselves 10 questions before acting, with the list topped by: ‘Do I really need to take any of my pension money now?’ See the full list below.

Source: State Street Global Advisors and The People’s Pension

Avoiding paying tax should be a big consideration, both here and at later stages in the retirement process.

If you are used to being taxed at the 20 per cent basic rate, suddenly withdrawing big chunks of money might push you into the higher-rate 40 per cent or even the 45 per cent tax bracket.

Therefore, be aware that if you take too much out of your pot in one go, you could end up with an unnecessarily big bill from the taxman.

Another thing to bear in mind is that once you start making withdrawals, limits will be placed on how much extra money you can contribute to your pension pot and still automatically get tax relief. The annual amount falls from £40,000 to £4,000 a year, to prevent people recycling their savings to gain a tax advantage.

The situation is a bit different for people earning £150,000-plus a year, as they get a lower annual allowance on a sliding scale that goes down to £10,000 anyway.

Age 55 is a ‘false deadline, or rather false startline’ on the retirement path, according to Old Mutual Wealth financial expert Adrian Walker. But he thinks it is a good point to explore your pension options, and make some changes if necessary.

If you are in a ‘defined contribution’ scheme, where you and your employer contribute to a pot of money for your retirement, then find out if flexible or phased withdrawals will be available, he suggests.

You should also check if you would get a guaranteed annuity rate – better than you could get on the open market now – and if so when it would be available, and whether it would be suitable for your needs in terms of inflation-proofing and ongoing benefits for your spouse, Walker explains.

He says other areas to look at are exit charges in case you want or need to transfer your pension pot elsewhere, although this will be less of an issue from next Spring when such fees will be capped at 1 per cent.

Also, Walker suggests checking whether your current investment strategy matches your likely intentions when it comes to eventually turning a pension pot into an income.

People nearing retirement traditionally switch savings out of risky investments and into safer assets, but pension freedom reforms have prompted a big rethink of this practice.

That’s because derisking your pension savings – or ‘lifestyling’ them, as it’s known in industry jargon – is normally done in preparation for buying an annuity. When you trade in your nest egg for an annuity, you want it to be as big as possible – you don’t want to risk a big drop in its value just before.

However, if you’re not planning to take all of your pension or buy an annuity when you retire, a drop in value at retirement age is not such a big deal as you still have time to bring it back up again, and it may be worth the risk in exchange for the possibility of higher returns over the longer term.

Passing years: If you’re well prepared to navigate the years between 55 and 75, you can mostly arrange your transition into retirement to your own liking and individual needs

If you have a final salary or ‘defined benefit’ pension, which provides guaranteed and usually generous payouts for life, this can be a good time to check what the scheme’s ‘selected retirement age’ is and whether there would be any penalties for retiring early. These issues are explained in more depth below.

Your state pension age will still be some way off, but if you haven’t got a state pension estimate already then it’s sensible to do this now and factor it into your planning.

If you have gaps in your National Insurance record, there’s still time to fill them in and buy voluntary top-ups, especially if you want your state pension to get nearer or reach the full new flat rate of £175.20 per week.

The Government’s state pension forecast website is here.

Age 60 to 65: Find out ‘selected retirement age’ on your private and work pensions

At this stage, you definitely need to get to grips with your state pension. We are currently in a transition stage where the age when you can start drawing it is already on the rise for women, and soon going to be hiked for men, to take account of everyone living longer.

Both men’s and women’s state pension age is now 66. State pension age will increase between 2026 and 2028 to to 67 for everyone. Check out our full guide here.

Just because you can start drawing your state pension, doesn’t mean you have to do so at the first opportunity. If you can afford to defer it, your eventual payouts will be bumped by 5.8 per cent for each year you delay.

Assuming you are not in immediate need of a retirement income it’s worth doing the sums to see if you would come out ahead.

The Government offers guidance about deferring your state pension here. This period also offers the opportunity to buy top-ups and fill in missing NI years to boost your state pension (see above).

Meanwhile, people with old-style private pensions – such as retirement annuity contracts and with profits contracts – need to look up and take particular note of any ‘selected retirement age’ specified in them, warns Mark Stone, financial planning director at Whitechurch Securities.

Mark Stone: Checking the ‘selected retirement age’ on private and work pensions is very important

Many contracts were set up in the expectation that savers would start drawing a pension at the age of 65, and choosing a different date means you could face exit fees, lose out on promised benefits or see payouts reduced, he explains.

Stone suggests you also check if there is a cut-off point, such as age 75, which restricts your options after that point.

‘Old-style agreements, the way they are written, could stop you from doing something you want,’ he says.

Stone says similarly close attention should be paid to the ‘selected retirement age’ on workplace final salary pensions, which provide a guaranteed income until you die.

‘If you take it early, there could be an “actuarial” rate reduction, and the reduction can be quite severe – one third off your income,’ he cautions. ‘Ask your pension department or administrator and check your scheme’s pensions handbook if you want to retire early.’

He also notes that you could lose protections built into ‘section 32 pensions’ – where a final salary fund has been converted at some point into an insurance policy – if you don’t take the pension on the designated start date.

These policies can offer protected tax-free cash which is greater than the usual 25 per cent, depending on your service and salary record.

‘Defined contribution’ work pensions, where you and employer contribute to a pot which can be turned into an income at retirement, can have a ‘selected retirement age’ too. Again, it’s important to check in advance.

Age 70 to 75: Contractual cut-offs and inheritance planning

Now savers have many more options on what do with their pension savings besides buying an annuity, age 75 is no longer such an important cut-off date.

However, it still appears as a deadline in many pension contracts, so as explained above you should check them carefully to make sure you don’t lose out by letting this birthday pass without taking action.

For example, if you have a defined contribution pension pot that you haven’t done anything with yet, you might have to transfer it or buy an annuity by the age of 75.

Adrian Walker: Age 75 is an important cut-off year if you are planning to pass on pension savings when you die

If you have an older type of income drawdown scheme set up before pension freedom reforms in April 2015, it might include a rule that you turn it into an annuity by that age.

Also, if you haven’t yet taken your 25 per cent tax-free cash from a pension pot, you might be barred from doing so after this point.

Meanwhile, Adrian Walker from Old Mutual Wealth warns that the tax treatment of any pension savings that could be passed on if you die will change at age 75.

Beneficiaries of inheritances pay no tax if a pension holder dies before age 75, but they must pay their normal income tax rate – with the money they receive added to their earnings to calculate this – if the deceased was 75 or over.

Walker suggests you consider whether to take any tax-free cash from your savings before you reach 75, in order to reduce the future potential tax liability of your beneficiaries.

He adds that when you reach 75 the taxman will also test any untouched pension savings and any funds you hold in drawdown schemes against your remaining Lifetime Allowance – the total amount you can put in a pension pot during your life and qualify for tax relief. The Lifetime Allowance is currently £1,073,100.