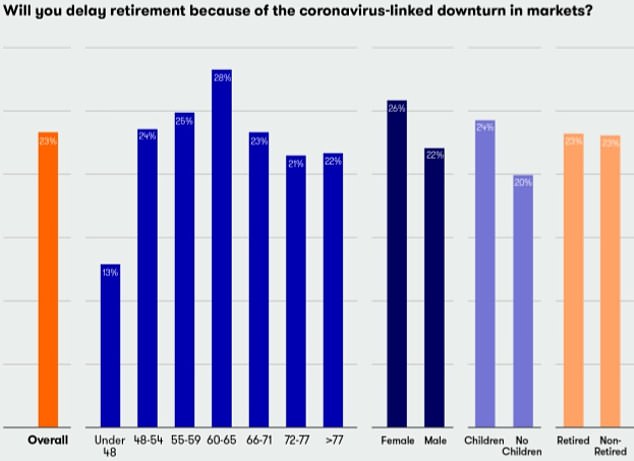

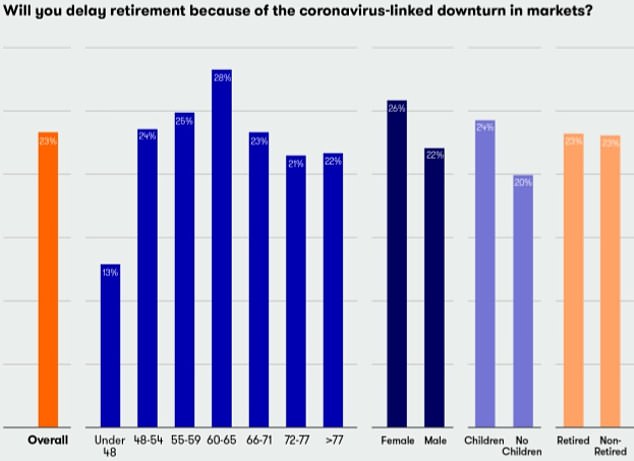

Warning the older generation is facing a bleaker, poorer retirement as Covid-19 has ‘sabotaged’ their pension plans

- A fifth of people approaching retirement are putting it off, finds survey

- Many fear investment losses in pandemic mean they can never retire

- Number who believe lifestyle will improve in retirement has halved in past year

Hardship caused by the pandemic is forcing many older people to delay retirement, while also assisting younger generations with money and childcare, new research reveals.

One in five people coming up to retirement expect to carry on working because of Covid-19, and there is a marked increase in working parents dipping into pensions to help children in the past year.

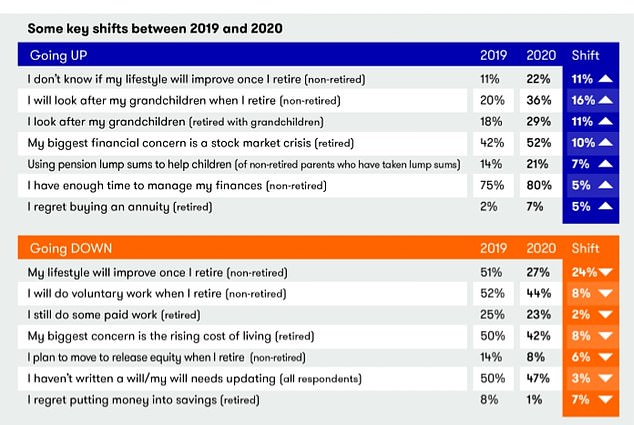

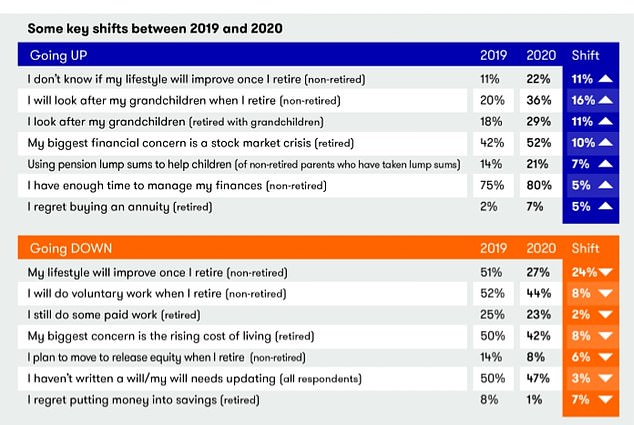

‘Last year more than half of those still at work thought their lifestyle would improve when they retired. This year that number has halved,’ says Interactive Investor, of its latest retirement survey of 12,000 adults.

Looking ahead: A quarter of people still working voiced fears that investment losses suffered in the pandemic meant they would never be able to stop work

This found that 21 per cent of people aged 60-65 are putting off plans to stop work because coronavirus has affected their pension fund, and 19 per cent of 66 to 71-year-olds who are still employed also intend to hold onto their jobs.

Some 25 per cent of those postponing retirement expect to wait a further year to stop, 34 per cent an extra two years, 23 per cent three years, 5 per cent for four years and 14 per cent for five years or more.

A quarter voiced fears that investment losses they had suffered in the coronavirus pandemic meant they would never be able to retire. UK stock markets have bounced from their lows early this year, but not fully recovered since the outbreak.

Meanwhile, 51 per cent of retired parents have already helped their children buy property, split by 41 per cent who gifted the money and 10 per cent who made a loan.

(Source: Interactive Investor)

And 21 per cent of parents who are still working have already used at least some of their tax-free pension lump sum to help their children buy a home, compared with 14 per cent in last year’s survey.

House prices have experienced a mini-boom since the initial Covid-19 lockdown was lifted this year, defying forecasts that a pandemic recession would deliver a severe shock to the property market.

Meanwhile, lenders have pulled most deals aimed at buyers with small deposits, which is likely to put further pressure on parents to fund them.

II says: ‘The average house price has risen by 1,170 per cent in the past 40 years – from around £20,000 to over £234,000 today.

‘Parents told us time and again how they had benefited from the house price boom but were now watching their children struggling to become homeowners.’

Its survey also found that 29 per cent of retired grandparents look after their grandchildren, up from 18 per cent in last year’s research.

Older parents who are still working expect to care for grandchildren too after retirement, with 36 per cent anticipating this compared with 20 per cent last year.

Some 44 per cent expect to do voluntary work in retirement versus 52 per cent last year, and 50 per cent see retirement as time to dedicate to themselves versus 55 per cent in the last survey.

(Source: Interactive Investor)

Other findings include:

– More than a third of Londoners plans to relocate on retirement, compared to a quarter of people overall

– Some 52 per cent of retirees have not made preparations to fund care costs, but are worried about it

– Among divorcees, 57 per cent had not discussed pensions when negotiating a settlement.

– Covid-19 has ‘sabotaged’ pension plans, and a majority of retirees say a stock market crisis is their number one worry.

Moira O’Neill, head of personal finance at II, says: ‘The Covid-19 pandemic has created uncertainty for everyone. With jobs in jeopardy and incomes slashed, many are turning to their parents for help – whether it’s for a cash bailout, support to get on the property ladder or childcare.

‘But the older generation is suffering too, with many having seen their savings rocked.

‘If the Bank of Mum and Dad was a regulated institution there would be urgent calls for a review of its liquidity and the unions would be raising the alarm about unpaid labour! Not surprisingly many older savers are feeling gloomy.’