Inheritance tax take falls for the first time in a decade as £1million own home limit kicks in – but will the Chancellor tinker with it to bolster the Treasury coffers?

- Amount of money raked in from inheritance tax dropped by over £200m

- Residence nil-rate band was primary driver behind fall in receipts, HMRC said

- Amid rocketing public spending, Chancellor Rishi Sunak could have tax in sight

The amount of money raised from inheritance tax fell for the first time in a decade last year, new figures from HM Revenue and Customs have revealed.

The amount of cash raked in from the death tax slumped £223million, or 4 per cent, in the 2019-20 tax year, but the charges still bolstered the Treasury’s coffers to the tune of £5.2billion.

With the Government furloughing scheme alone costing more than £30billion to date, Chancellor Rishi Sunak could have an IHT hike in his sights in the Budget later in the year.

The introduction of the residence nil-rate band in the 2017-18 tax year was the main reason IHT receipts and number of people paying the tax fell last year, HMRC said, with the changes taking time to fully filter through.

What’s he planning? Chancellor Rishi Sunak could have inheritance tax in his sights this year

Inheritance tax: Receipts and proportion of people hit with inheritance tax through time

No changes to the tax were announced in either the Chancellor’s March Budget or summer statement.

But, this year’s explosion in public spending and borrowing means the Chancellor could be forced to make radical economic decisions, potentially including tax hikes, to help Britain’s financial recovery in the years ahead once the Covid-19 pandemic subsides.

Tom Selby, analyst at AJ Bell, said: ‘Given the parlous state of the nation’s finances, it would be no surprise to see Osborne’s big IHT giveaway come under the microscope as his successor, Rishi Sunak, seeks ways to raise much-needed cash to pay for the nation’s eye watering COVID-19 debts.’

With last years’s inheritance tax receipts dwindling, Mike Hodges, a partner at Saffery Champness, thinks the figures ‘may increase the perception that those who some may say can afford to pay a little more tax are not shouldering their fair share.’

Mr Hodges added: ‘And the proportion of estates paying IHT is likely to dwindle still further in the current financial year as the residence nil rate band increases to £175,000 per person, in accordance with George Osborne’s ambition that parents be able to leave a £1million property to their children tax-free.’

UK-based people with non-domicile tax status, also known as ‘non-doms’ could become a particular target for the Chancellor if inheritance tax bands or rules are changed.

Mr Hodges said: ‘Clearly the Chancellor is on the look out for sources of revenue to bolster the coffers drained by the government’s relief efforts and his eye may turn to non-doms, particularly given the persistent rumblings about a wealth tax.

‘Non-doms will likely be considered a safe target politically, but the Chancellor will need to be mindful to not throw the baby out with the bathwater with non-doms providing a significant source of investment in the UK economy – something which he will hope continues post-Brexit.’

Sam McCann, a financial planner at NFU Mutual, said: ‘The government does have to claw back some cash to help pay for coronavirus, and inheritance tax is ripe for reform, so Rishi Sunak could review it in an attempt to help plug the hole in the national finances.’

HMRC said the drop in last year’s IHT receipts followed the introduction of the residence nil-rate band by former Chancellor George Osbourne back in 2017.

The residence nil-rate band offers up to £175,000 relief on the value of a home, on top of the £325,000 already transferable tax free.

Falling: The number of people paying inheritance tax fell for the first time since 2009 last year

People managed to shelter £3.1billion from the Revenue as a result of the introduction of the main residence nil-rate band in 2017-18, HMRC said today.

The additional allowance enables individuals to pass on up to £1million to their loved ones tax free.

Until 2007-08, total inheritance tax receipts had been climbing steadily, mainly due to increases in asset valuations of things like houses prior to the financial crisis.

In the following years, this trend took a downward turn, despite the total net capital value of estates remaining broadly unchanged between 2007-08 and 2009-10 at £62billion.

Since 2009-10, the average amount of tax paid per estate increased each year by an average of 3 per cent, or by £4,200, until 2014-15.

In 2015-16, the average amount of inheritance tax paid per estate fell slightly by £2,000 to £179,000.

HMRC said: ‘This was driven by a combination of those net estates valued between £1 and £2million increasing in numbers slightly while the total tax charge levied on those estates remained flat.

‘The average liability remained broadly similar in 2016-17, but increased by 10 per cent (£18,000) in 2017-18 to £197,000 overall.’

This week, the Office for National Statistics said that in 2017-18, 3.9 per cent of all UK deaths, which totalled 620,000, resulted in an IHT charge.

One tax expert thinks the pandemic could, at some point in the future, lead to the abolishment of IHT in its entirety, particularly if some form of wealth tax is on the cards.

Tom Elliott, a partner and head of London private clients at Crowe UK, said: ‘My personal view is that, if the Treasury is seriously considering an annual wealth tax, this would provide the perfect opportunity to not just reform IHT but do away with it completely.

‘Politically, the Government would be seen to be continuing to tax wealthy estates, albeit in a different format and if a wealth tax is deemed necessary, it will be more acceptable to those exposed to it if they were to be excused from their current exposure to IHT.’

Mr Elliott added: ‘The total IHT paid in 2019/20 represented less than 1 per cent of the total tax take for the UK (£602.2bn).

‘IHT is more of a policy tax and political tool than a revenue raising strategy. So few estates pay the tax that it would hardly be a vote-loser if the rate was increased. If anything, such a proposal would be a politically positive step.’

Inheritance tax by gender and geography

Today’s figures from HMRC also provide some deeper insights into the geographical and gender differences when it comes to inheritance tax charges across the UK.

In the 2017-18 tax year, on average, a man’s estate had a net capital value of £1.2million and a tax charge of £197,200. Meanwhile, an average estate for a female had a lower net value of £1.1million, but a higher average tax charge of £198,500.

‘In general, female-owned estates tend to have higher tax charges than those owned by males. This is likely due to the fact that females tend to have higher life expectancies at birth than males’, HMRC said.

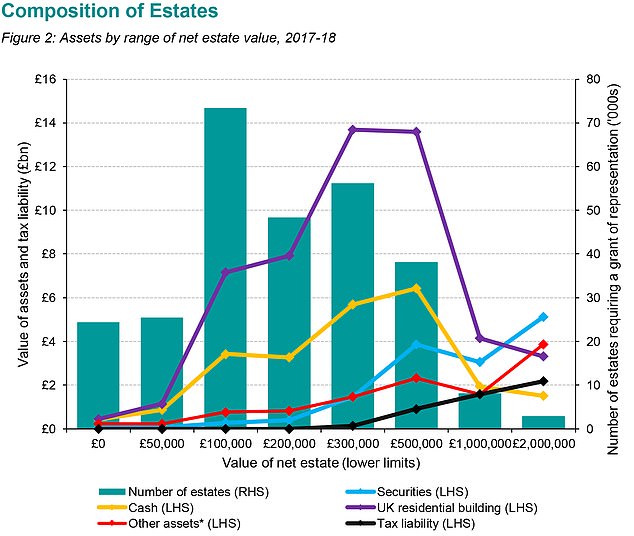

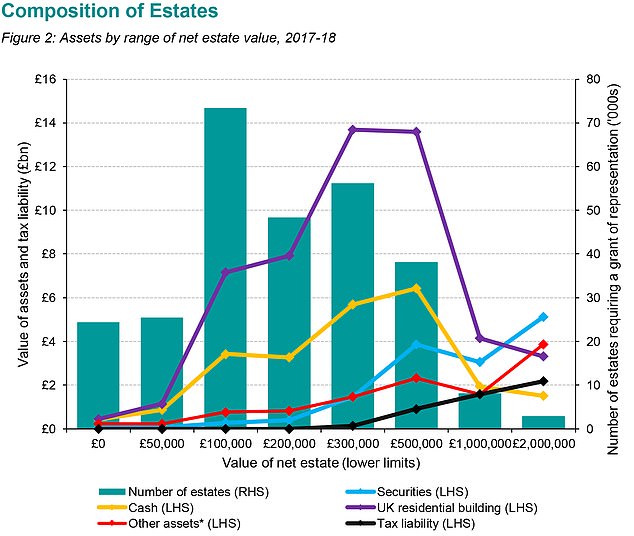

Estates: The composition of estates for inheritance tax purposes in 2017-18

Trusts: HMRC’s latest figures revealed how trusts operate in respect of inheritance tax

On the geographical front, with higher than average house prices, people in London and the South East were the most likely to be slapped with an inheritance tax charge in the 2017-18 tax year.

In 2017-18, 54 per cent of the total amount of inheritance tax charged in England was concentrated in these regions alone, with the average taxpayer in London charged £245,400.

London and the South East account for 45 per cent of all inheritance tax receipts even today, HMRC said.

By contrast, in 2017-18, the lowest IHT paying regions had average charges of £133,500 in Wales, £146,800 in the North East and £152,200 in Northern Ireland.

‘This may have been attributed to lower house prices in those regions’, HMRC said.